PPR, also known as main residence relief, remains an important and worthwhile tax relief. For the majority of individuals, the family home is often the most valuable asset they will ever own. Where a family home has been occupied as an individuals only or main residence throughout ownership, PPR will fully exempt any profit on disposal from Capital Gains Tax (CGT).

PPR also operates to partially exempt some of the capital gain arising on the disposal of a dwelling house which has been the only or main residence for part of the ownership period. Where the house has been occupied as a main residence at some point but also let at another time, lettings relief may further reduce or eliminate any capital gain.

To claim PPR, most crucially, the dwelling house must as a matter of fact be physically occupied as a residence by the individual(s) at some point during their period of ownership. There have also been a spate of tax cases in the past three years where HMRC have scrutinised the quality and permanence of occupation required to make a successful claim. In Bradley v HMRC 2013, although the house was occupied by the taxpayer for a short time, the court held it was never the taxpayer’s intention at the time of moving in to live in the house permanently and PPR was denied. In Morgan v HMRC 2013, the taxpayer needed to show at the time of moving into the house, it was his intention to make it his permanent residence (even if he changed his mind a week or so later). The case of Iles & Another 2014involved short term occupation and highlighted the need for clear evidence that a property is suitable and will be used as a permanent home and not merely a temporary stop gap.

There are certain circumstances where the legislation deems a house to be an individuals’ main residence for periods of absence or inoccupation. For example, there is deemed occupation in the final 18 months of ownership provided the house has been the main residence at some point during the period of ownership. Actual occupation at some point as a residence is a prerequisite to the deeming provisions.

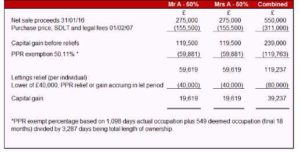

The below example demonstrates how the relief works in practice:

Mr & Mrs A jointly purchase a house for £300,000 on 31 January 2007 and move in. They occupy the house as their main residence for three years before moving out. They then let the house to tenants from 1 February 2010 up until 1 August 2014. The house was then vacant up until sale on 31 January 2016.

If you would like to discuss this relief further, please get in touch with Charmain Alway or your usual Mercer & Hole contact.

7 mins

7 mins