Gifting land or buildings, say a buy-to-let residential or commercial property, to a charity in ones lifetime could be an attractive option to those who have earmarked a proportion of their estate for charity.

It is worth remembering that following rules introduced in 2012, where an individual leaves at least 10% of their estate to charity under their Will, the rate of Inheritance Tax is reduced from 40% to 36%. Furthermore, beneficiaries are able to execute a Deed of Variation to vary the Will within two years from the date of death and increase the percentage to charity if desired. There can be surprising results from this and often the main winners are the charities concerned with the beneficiary remaining in exactly the same position.

In this article we touch on the reliefs available for lifetime gifting of land and buildings, the rules in more detail and also the flexibility a charitable settlement as a suitable recipient can afford you and your family.

The relief

Most individuals will be familiar with the Gift Aid scheme and have probably ticked the ‘Gift Aid box’ when making a cash donation to allow the charity to claim an extra 25p for every £1 donated. Where an asset is directly gifted to charity no such declaration is required and the donor obtains income tax relief either through an adjustment to their PAYE code or via their self-assessment tax return.

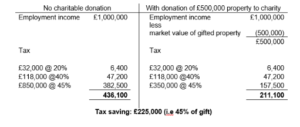

Income tax relief is provided by way of a deduction from the donor’s gross income equal to the market value of the gifted asset plus any incidental costs of the transfer, e.g. obtaining a valuation. There will be no capital gains tax payable on the transfer of the property to the charity. In the best case scenario, a gift to charity could actually cost an additional rate tax payer just 55% of the value of the property as shown in the example below:

There can be merit in matching ‘income’ for the year with the total value of the gift, such as using it as an opportunity to encash an offshore bond. It is also possible to sell the asset at undervalue to a charity ahead of a sale to a third party and to use the relief for the partial gift.

Any rental income generated when the property is in the hands of the charity will be completely income tax free. This can stop the merry-go-round of gifting cash under Gift Aid to the charity each year, upon which they reclaim 25p for every £1, and the individual then needing to reclaim further tax relief through their tax return.

The rules

There are rules and regulations governing gifts of this nature which are as follows:

The property must be situated in the UK.

The individual must dispose of the whole of their beneficial interest.

Where an asset is owned jointly, all parties must agree to give the property.

The relief must be claimed in the tax year in which the gift is made – unlike Gift Aid it is not possible to carry the relief back.

Charitable settlements

It may be difficult to identify just one charity to benefit from the gift and a charitable settlement could prove to be a solution to this. The settlement would be run by trustees which could (but does not have to) include the donor. Importantly, a charitable settlement would enable the family to remain in control of the gifted asset and the settlement’s objective could be kept very general or alternatively could specifically name charities, or a class of charities which support the same cause.

Making a gift in lifetime allows the donor to see the benefit of their donation and the biggest attraction of a charitable settlement is the flexibility offered.

To discuss the potential of gifting land or buildings to charity, please contact Lynsey Lord or your usual Mercer & Hole contact.

7 mins

7 mins