Despite employees only starting to see the benefit of a two percentage point reduction in the main rate of National Insurance from 12% to 10% in the last couple of months, a further two percentage point reduction in this rate to 8% is coming.

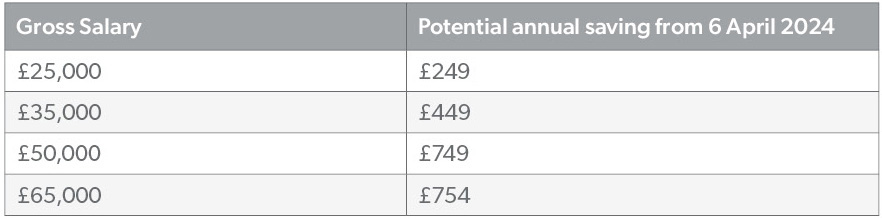

This further reduction will come into effect from 6 April 2024. Some examples of the potential savings are set out below.

The above savings are in addition to the savings from the previous two percentage point reduction which took effect from 6 January 2024.

There were no similar reductions for Employer National Insurance Contributions and those rates remain unchanged.

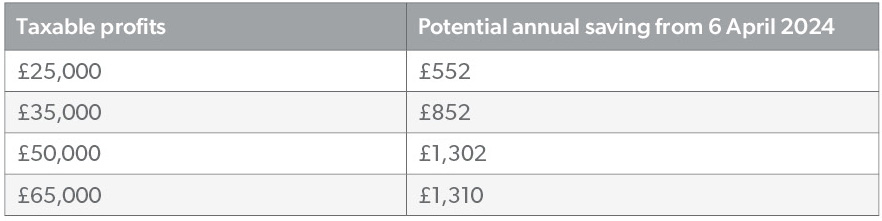

Self-employed individuals were set to see a one percentage point reduction in Class 4 contributions (paid on profits between £12,570 and £50,270) with effect until 6 April 2024. However, this is now a three percentage points reduction with effect from the same date. Combining this with the abolition of Class 2 National Insurance Contributions (£3.45 per week) from 6 April 2024 for those self-employed individuals with profits greater than £12,570, some examples of the potential savings are set out below:

Contact us

Please do not hesitate to contact Mark if you would like to discuss in further detail how this might affect you.

7 mins

7 mins