Broadly speaking individuals, who have been living abroad for a number of years and are thinking about a return to the UK, can mitigate a UK tax charge on the disposal of properties, by selling prior to their return to the UK. As seen in the case of Margaret and Bernard it is, however, worth checking that they will not fall into any traps which end up with them facing an unnecessary UK tax charge.

Their story

Margaret and Bernard Sterling left the UK in May 2010 as Bernard was given an end of career opportunity at age 60 to work overseas.

As they were a bit nervous about how things would work out, they decided to hold on to their UK property in Wimbledon which they bought in 1990 for £250,000 and had lived in until their departure in 2010. The UK property was rented through an agency and they used cash savings to purchase a city centre flat near Bernard’s new overseas work for £750,000.

They made return visits to the UK every year to see family but normally for no more than 6 weeks per year. However, when their first grandchild was born on 1 June 2013, Margaret stayed in the UK for a full 6 months (during the 2013/14 tax year). Similarly, when the second grandchild came along on 5 July 2016, she stayed in the UK for just over 3 months that year (during the 2016/17 tax year).

Having built up a significant retirement pot, they want to return to the UK as soon as possible but before 5 April 2018. They have already received an offer for their overseas property equivalent to £1.5million. They intend to gift the entire sale proceeds equally to their 2 daughters, who are both UK resident.

The letting on the Wimbledon property is coming to an end but Margaret does not really want to return to live in it. She wants to live in Dorset and already has her eye on a retirement property there. The Wimbledon property is now worth £3m and has been about the same value for last 2 years.

They have established that there is no capital gains tax in their country of residence and wonder if it matters about which property is sold first. Both properties are owned jointly.

Back to basics

Given that in the circumstances above, there is no capital gains tax in the jurisdiction in which they are currently resident, their UK residence status and the subsequent implications of the timing of the disposals are fundamental as to their exposure to any UK tax charges on the property disposals.

Since 6 April 2013, residence has been governed by the statutory residence test (SRT) [s218 FA2013.] When the Sterlings left the UK in 2010, however, residence was not statutorily defined but rather determined by case law. Rather than go through the old rules here, it must be assumed that they did satisfy the conditions to be treated as not UK resident when they left the UK. We will now turn to the rules within the SRT to establish their UK residence position in the tax year of return.

Statutory Residence Test (SRT) – getting into the detail

In essence, the SRT is bookended by 2 sets of tests which determine that you are either automatically UK resident or automatically not UK resident. The order of how they are applied is important and not straightforward.

Firstly, the easy one, is a day count for automatic UK residence. Anyone who spends over 183 days in the UK (present at midnight) in the tax year is automatically UK resident. Taking days in the UK in the summer and their planned return date into account, it is clear that the Sterlings will not exceed 183 days in the year ended 5 April 2018.

We then jump to consider the 3 automatic non UK resident tests to see if they apply to the Sterlings:

- Anyone who spends fewer than 16 days in the UK is automatically non-UK resident

- Anyone resident in the UK for none of the 3 tax years preceding the tax year who spends fewer than 46 days in the UK in the tax year is automatically non-UK resident.

- Anyone working full-time overseas over the tax year, without any significant breaks during the tax year from overseas work is automatically non-UK resident.

The Sterlings will not meet any of the above tests. Given their summer visit, they have already exceeded 16 days and will be over 46 days before the year is out The last one can be discounted due to their retired status.

We then go back to the 2 remaining tests to check whether they are automatically UK resident, which will applies as follows:

1.Anyone who works full-time in the UK for any period of 365 days, with no significant break from UK and

- all or part of that 365-day period falls within the tax year

- more than 75% of the total number of days in the 365-day period when more than 3 hours of work are days when they do more than 3 hours of work in the UK

- at least 1 day which is both in the 365-day period and in the tax year is a day on which they do more than 3 hours of work in the UK

2.The home test – this considers whether an individual has a period of at least 91 consecutive days in which:

- they have a UK home (in which they are present for over 30 days in the tax year), and either they have no overseas home, or

- an overseas home in which they are present for fewer than 30 days in the tax year.

Although there for completeness, the first test does not apply to the Sterlings. However, the home test could be a bit trickier. Of this 91 day period that meets these conditions, only 30 days are required to fall in the tax year in question for an individual to be treated as UK resident. The interesting point here is that the Sterlings have firm plans to sell their overseas home. The timing of this disposal could therefore have a significant impact on their residence status for the 2017/18 tax year as they could fall into the conditions for the home test and be automatically UK resident.

As such Margaret and Bernard would be wise to retain the overseas home, until 6 March 2017, in order that there cannot be a 30 day period in the 2017/18 tax year to trigger UK residence under this automatic home test.

On to the tie test

Subject to them not meeting the automatic home test, the next stage is to consider the sufficient ties test. This looks at the number of ‘ties’ to the UK in conjunction with the days spent in the UK to determine residence.

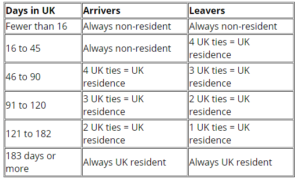

The number of days to be treated as UK resident is reduced for those ‘leavers’ who have been UK resident in any of the previous 3 tax years, to make it harder to lose UK residency. The position for both ‘leavers’ and ‘arrivers’ is shown in the table below.

Sufficient ties table

The UK ties are:

- the family tie – a UK resident partner and/or UK resident children under the age of 18;

- the accommodation tie – having a UK home available for at least 91 days and using it for at least one night in the tax year;

- the work tie – working in the UK for more than 3 hours on at least 40 days in the tax year;

- the 90-day tie – being present in the UK for more than 90 days in either or both of the preceding 2 tax years; and

- the country tie (only applicable for leavers) – where there is no other country in which the individual spends more midnights.

We have to consider Margaret and Bernard separately:

On the face of it Margaret definitely has two ties to the UK – the accommodation and the 90 days ties. Potentially she could also have a family tie if Bernard was UK resident, but that seems unlikely. So based on two ties, if she should spends more than 120 days in the UK, she will be UK resident.

Whilst Bernard only appears to have one tie being the accommodation one, he could also have a family tie if Margaret ends up being UK resident.

The advice must be that they both avoid spending more than 120 days in 2017/18 and stay out of the UK residence net. They will need to be accurate about the days spent and a careful check of the dates they have already spent in the summer will be necessary. They should defer their return date in order to stay within the 120 total day limit.

Sale of properties if they were UK resident

Subject to the above, if the sale of the UK property took place when the Sterlings were both UK resident, then the gain would be calculated in the normal way of proceeds less cost; with the gain reduced by the available principal private residence (PPR) relief. The PPR relief would include the period of actual occupation to 2010, lettings relief and a deduction for the last 18 months.

Whilst Margaret has indicated that she does not wish to return to the Wimbledon property, if it is unavoidable that UK residence will be met in 2017/18, the UK property gain could be mitigated by additional PPR, if they were to return to the property [s 223(3)(b) TCGA 1992]. However, in the absence of a PPR nomination within 2 years of the acquisition of the overseas property, PPR in the overseas period would apply to the overseas property based on the facts of their actual occupation.

The overseas property would be subject to CGT if they are UK resident at the point of sale, but Margaret and Bernard should receive PPR for both the period of occupation and the last 18 months.

The position could be improved further by them remaining not UK resident in 2017/18.

Sale of the properties when non-UK residents

Although the timing might be tight on a practical basis, it is worth looking at the positon if the sale of the UK property takes place in 2017/18 and Margaret and Bernard are both not UK resident at the time. A NRCGT (non- resident capital gains tax) return will be required within 30 days of completion of the sale. The default NRCGT tax charge is on the increase in value since 5 April 2015. In these circumstances the UK property has maintained a value at £3m and as such no NRCGT charge is likely to be due (and the alternative methods of NRCGT calculation can be ignored in this case). If the values were disputed and the calculation did result in some tax being payable then, assuming that they submit self-assessment returns in respect of the rental income, the tax payment can be deferred until 31 January 2019. Otherwise the tax would be payable when the return is submitted,

There should be no UK consequences on the sale of overseas property whilst they are not UK resident, but local overseas advice should be sought.

Temporary non residence

Whilst, there is no NRCGT in 2017/18, a return to the UK can prompt a tax charge under the temporary non-residence rules in 2018/19 when Margaret does become UK resident.

- Given that Margaret has spent over 6 months (183 days) in 2013/14 in the UK, she was UK resident for that whole tax year (no ‘split year’ treatment available).

- Both properties were owned by Margaret during 2013/14 and sold during a non-UK resident tax year (2017/18).

- She had been resident for 4 out of the 7 tax years prior to 2013/14.

- Margaret was not absent (i.e. not UK resident) for at least 5 years (note years,not tax years).

As such the disposal of both properties in 2017/18 by Margaret will be caught by the temporary non-residents rules. Broadly Margaret will be taxed on the full gains in 2018/19 with a deduction for any gain chargeable on the UK property under the NRCGT rules.

Improving the position where one spouse is a temporary non resident

Margaret could transfer her share of both the properties to Bernard in 2017/18 prior to the disposal. There is no gain on the transfer to Bernard under TCGA92/S58 nor on his ultimate sale as he is not caught by the temporary non-UK residence rules. The General Anti Abuse Rules (GAAR) should be considered but transfers between spouses is specially mentioned as being excluded from being caught by GAAR.

Gift to daughters

The onward gift of the property sale proceeds to the daughters will incur no further capital gains tax. The gifts will be potentially exempt transfers (PETs) for inheritance tax purposes and potentially within Margaret’s and Bernard’s estates in the event of their deaths within 7 years of the gifts.

Ideally the gift should be made jointly by Margaret and Bernard to share the risk of the full value becoming chargeable to IHT in the event of one of one of them making the full gift and subsequently dying within 7 years. As such, if the properties have been transferred into Bernard’s name only to mitigate the tax under the temporary non residence rules, and it is only he who gifts the cash, this will increase the risk of potential IHT in the event of his death.

Planning

Margaret and Bernard’s situation is not untypical but they will need to properly plan the timing of their return given the traps of the SRT and the temporary non-resident rules that lie in wait for them.

7 mins

7 mins