Mortgage interest relief is now being restricted for individuals holding loans to acquire residential properties for investment purposes. From 6 April 2020 income tax relief will be limited to the basic rate of income tax at 20% only for interest on buy-to-let residential properties. This restriction is already being phased in as my colleague Alice Pearson has mentioned in the previous article.

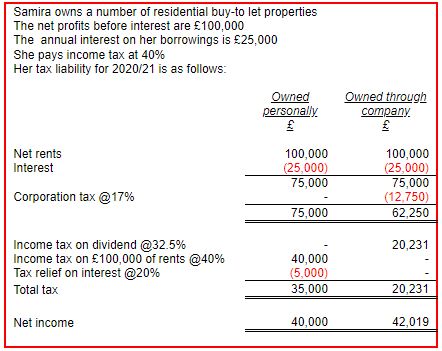

For this reason many people are considering acquiring their buy-to-let properties through a company. This is best illustrated with an example:

The illustration assumes that the company distributes all of its income by way of dividend.

It may be that Samira does not need to distribute all of the company’s income to her but retain some in the company for re-investment. In that case she shelters some of the profit from income tax and as a result there is a further benefit of holding the properties in the company.

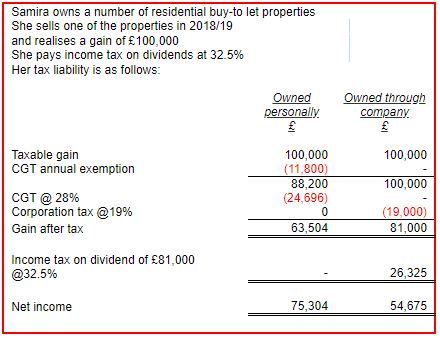

A further potential benefit of holding the properties through a company is that when the company sells a residential investment property it usually pays corporation tax on the gain at corporation tax rates. The current corporation tax rate is 19% and is due to reduce to 17% in 2020. In addition, in calculating the gain the cost of the property is indexed for inflation (indexation allowance) but only up to 1 January 2018. This contrasts with an individual, such as Samira, who pays Capital Gains Tax (CGT) at the higher rate of 28% (18% for basic rate taxpayers) on the disposal of a residential property held as an investment and is not entitled to any indexation allowance. However, if the company sells the property the funds from the disposal will then be in the company. If Samira wishes to withdraw the funds from the company rather than re-invest the proceeds there will then be a further tax charge on the payment of the dividend.

Example: Samira owns a number of residential buy-to-let properties. She sells one of the properties in 2018/19 and realises a gain of £100,000. She pays income tax on dividends at 32.5%.

Her tax liability is as follows:

The illustration assumes Samira has no other gains in the year. Thus, if she reinvests all of her proceeds she saves £5,724 of tax by holding the property in the company. However, if she distributes all of the profits as a dividend she is in isolation £20,601 worse off holding the property in the company.

Samira also needs to be aware that there are some potential tax charges on incorporation. If and when she transfers her properties to the company there is a potential taxable chargeable gain on her. The gain is on the market value of the properties on the date of the transfer less what she originally paid for them and the rate of tax is 28% (18% for basic rate taxpayers).

Samira may qualify for incorporation relief in which case no CGT charge arises and the gain is effectively deferred. Incorporation relief is available if she transfers the whole of her property business and all of its assets (except for cash) to her new company in exchange for the issue of shares to her by the new company. However, HMRC generally will not accept that the passive holding of a few property investments represents a business and the activity needs to be more substantial to constitute a business.

In addition, on the transfer of the properties to the company, Stamp Duty Land Tax (SDLT) will be payable on the market value of the properties. A possible way around this is for Samira to transfer the properties firstly to either a partnership or a Limited Liability Partnership. This then operates as the property business for a few years and it can then usually, based on current legislation, transfer the properties to a company without SDLT. This solution may not work for Samira as she owns all of her properties herself but may work if say she owns the properties jointly with her husband.

If you would like to discuss any of the aspects raised in this article in more depth, please contact David Hadley or your usual Mercer & Hole contact.

7 mins

7 mins