In a bid to prevent NHS consultants and other in demand professionals from scaling back their hours or retiring early, the Chancellor made some changes to pensions contributions in the Spring Budget 2023.

These changes have made the payment of pension contributions a more attractive proposition for people whose funds were already in excess of the current standing Lifetime Allowance (LTA) or whose funds were likely to exceed it at the point when they are measured against it. The tax-free cash entitlement for these people will still be restricted to 25% of the LTA, however, their pension funds in excess of this amount will no longer be subject to an LTA tax charge, which is a significant benefit.

Tax-free cash

The attraction of making pension contributions lies in their tax treatment. Contributions attract Income Tax relief at the payer’s highest marginal rate. 25% of the fund (or LTA, if lower) can be drawn as tax-free cash. The remainder of the fund is subject to Income Tax on extraction. The level of tax-efficiency depends on the relationship between the rate of tax relief obtained on contributions and the rate of Income Tax paid on extraction. However, it is likely that most people will pay lower rates of tax in retirement than whilst they are working. Even if the same rates of tax apply, the fact that some of the funds can be drawn as tax-free cash means that you are effectively ‘up on the game’ as a result of making pension contributions.

Free of Inheritance Tax

Aside from this, it should also be borne in mind that pension funds are not normally subject to Inheritance Tax on your death. The removal of LTA tax charges means that pension contributions are even more attractive as an Inheritance Tax planning tool.

We have produced some illustrations to demonstrate this point. We have assumed that the potential contributor has three different levels of pension funds already: £200,000, £800,000 or £1.5 million.

We have made some comparisons between making pension and Individual Savings Account (ISA) contributions. ISAs grow tax-free and the monies can be extracted free of tax. ISAs are the most tax-efficient vehicles for most people after pensions, so this very much represents a best-case comparison. ISA investment allowances definitely should be used, ideally in conjunction with making pension contributions.

- We have assumed that:

£20,000 (the maximum possible) is contributed to ISAs annually for five years - Gross pension contributions of £33,333 are made each year for five years (the net cost of a £33,333 gross pension contribution for a 40% taxpayer is £20,000, i.e., the same cost as investing in the ISA)

- The invested funds grow by 4% net each year

- The taxable element of the pension funds is extracted whilst paying 20% Income Tax and accordingly, we have calculated the net amount that can be extracted from the accumulated ISA and pension funds after five years

Please note, the pension fund extraction figures are based solely on the additional annual contributions made. They do not include the existing funds, although these are taken into account of in the tax calculations.

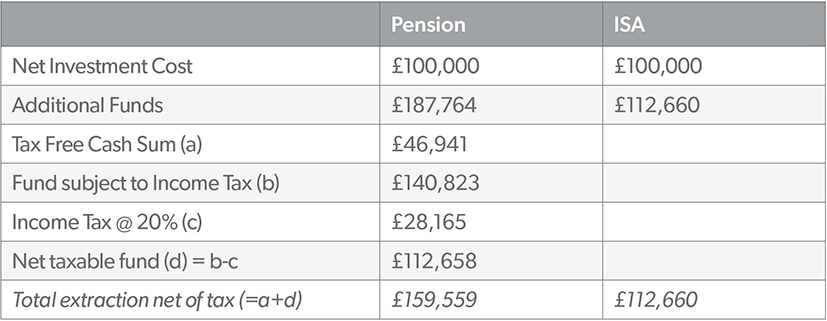

Mrs V has a £200,000 pension fund

The situation for Mrs V has not changed as their funds would not have been expected to breach the Lifetime Allowance in any case.

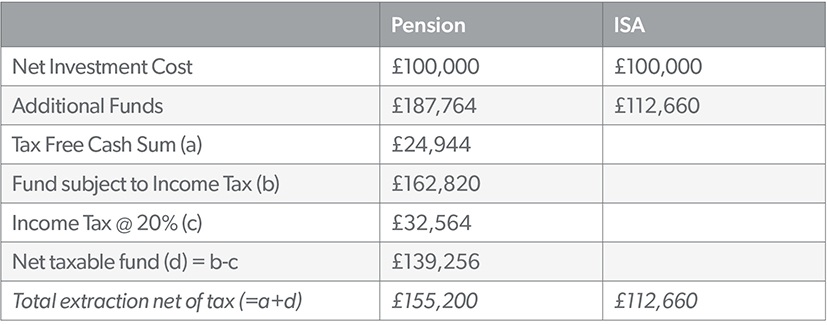

Mr B has a £800,000 pension fund

Mr B would previously have been wary about making contributions as he would have been worried about his funds breaching the £1,073,100 Lifetime Allowance and suffering a tax charge.

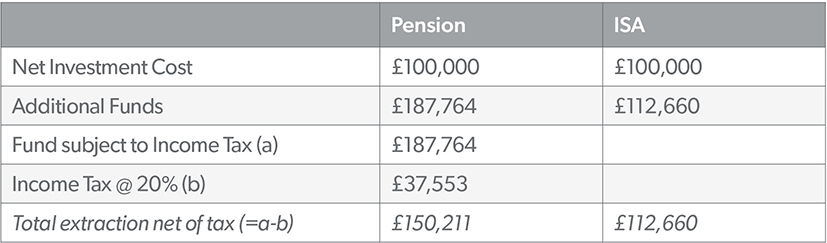

Miss A has a £1,500,000 pension fund

Miss A almost certainly would not have made contributions previously, as her funds would have been over the £1,073,100 Lifetime Allowance and would already be due to suffer a tax charge.

The right option for you

The recent changes to pensions contributions can be extremely beneficial to high earners or with a good amount of capital to plan for the future. When planning for the future, it is important to work with a skilled financial professional who can find a structure that is the most tax efficient and that fits your own individual circumstances. At Mercer & Hole, we keep abreast of the latest changes to tax regulation. We work with our clients on a long-term basis making changes to their financial plans and helping them to make the right choices when needed to ensure they are saving for their futures in the most tax-efficient way.

Contact us

If you would like any help or advice with your pension options, please don’t hesitate to speak to a member of our Financial Planning and Tax Teams at Mercer & Hole. We will be happy to help you.

7 mins

7 mins