The Chancellor has once again used the Budget to make the ownership of second homes less tax friendly; this time with a number of changes to the capital gains tax reliefs available when selling a property which has at any time been your main residence.

This measure will go further and impact not only those with buy-to-let properties but anyone who owns a property and moves out more than 9 months before the property is sold. For example separating couples where one party moves out before the sale of the family home.

What are the tax reliefs available on selling a former home and what is changing?

Principal Private Residence (PPR) relief

PPR relief protects taxpayers from being liable to Capital Gains Tax (CGT) during the period a property has been occupied as their main home. PPR relief covers not only periods of actual occupation but also other periods. This includes up to 12 months if refurbishing the property before moving in, time spent working away from home (subject to certain restrictions), as well as the final 18 months of ownership, regardless of occupation to protect those who have a cross-over period when replacing their main home.

For sales after 5 April 2020 the final 18 month “exempt period” is halving to 9 months. The change does not affect the relief available for those who have had to move out of their homes and into residential care and in this situation the relief remains 36 months.

Lettings relief

Where PPR relief is available and a property has been let out further respite from CGT is given in the form of Lettings relief which is available to reduce any chargeable gains arising during the let period. Lettings relief is the lower of the PPR available or the gain arising during the let period, subject to a £40,000 maximum per person. Therefore, Lettings relief can provide £80,000 tax relief for a couple selling their former residence which is a tax saving of £22,400.

From April 2020, Lettings relief will be scrapped for those not occupying the property at the same time as their tenants. This will serve to remove the availability of Lettings relief for everyone except owner-occupiers. The exact mechanism of how this will work has not been released.

How do these reliefs work in practice?

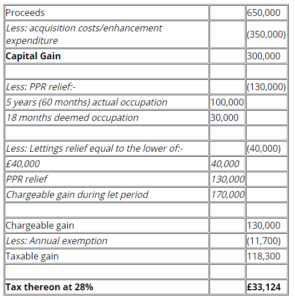

Under current rules (up until 5 April 2020)

Sarah purchases a flat for £350,000 and occupies this as her main home for 5 years until she moves into a house with her partner. Sarah chooses to rent out her old flat for the next 9½ years, after which time the property is left empty and put up for sale. The flat is sold 6 months later in June 2018 for £650,000 at which time Sarah is a higher rate taxpayer and realises a CGT liability of £33,124. In total Sarah owned the flat for 15 years (180 months).

Although Sarah only occupied the property for a third of the ownership period, more than half of the gain arising has been removed from the charge to tax through PPR and Lettings relief.

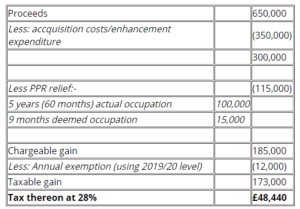

After changes implemented (from 6 April 2020 onwards)

If a sale took place after 5 April 2020, but all other conditions were the same as outlined above, Sarah’s tax liability would increase by £15,316 (even after taking into account the higher annual exemption).

What would happen if Sarah held onto the property for another 10 years?

We have used a 15 year occupation history to facilitate a direct comparison, but in reality once a taxpayer moves out of a property then the longer a property is owned the less valuable PPR relief becomes. This is due to the pro-rata method of calculation, which results in PPR relief becoming diluted over time.

From April 2020 Sarah will be entitled to 5 years 9 months of PPR relief over a 15 year ownership period, equal to 38.33%. If Sarah were to keep hold of the property for another 10 years then her PPR relief would be reduced to 23% relief on the gain arising over a 25 year ownership period.

Are HMRC burning the candle at both ends?

The reduction of the final PPR exempt period from 18 months down to 9 months comes shortly after a number of recent cases relating to a delay in the period between acquisition and occupation.

In R & C Commrs v Higgins [2018], Mr Higgins exchanged contracts for a property off-plan four years before completion took place and Mr Higgins began to occupy the property. Mr Higgins claimed PPR relief for this period, but relief was denied on the basis that he did not occupy the property (which did not exist at this time) for the period between exchange and completion. Although Mr Higgins appeal was not successful, HMRC insist they will not seek to impose a charge for the period between exchange and completion in most circumstances where the delay is reasonable, but the case reminds us of the importance of reviewing each situation on its own merits.

How long do you need to live in a property before it becomes your PPR?

The question of how long one needs to reside in a property for it to qualify as their main home for PPR purposes is one which is frequently raised, but as is so often the case with tax, the answer is not clear cut. In practice it is the quality of occupation not length of occupation that matters. A taxpayer must have intended to occupy the property with a degree of permanence and, for short occupations, the difficulty can be evidencing this permanence to HMRC.

Evidencing intention has proved the defining factor in many recent cases, such as Susan Bradley v HMRC (2013). When Mrs Bradley separated from her husband she moved into their second property and immediately placed the property on the market. This was taken to be evidence that the property was not intended to be occupied as a home with any degree of permanence and PPR relief was denied.

Conversely, if a property is acquired to be lived in long-term but subsequent factors make this impossible, such as a relationship breakdown, then a short term occupation can be sufficient to provide entitlement to PPR relief.

How do you know which property is your PPR?

A married couple can only have one PPR between them, so if a couple have multiple properties which meet the conditions of a home, then the one to be treated as the PPR will be determined by whether an election has been made. An election can be made whenever there is a change in circumstances such as the acquisition of a new property, marriage or divorce. Such an election should be made in writing (jointly for spouses) within two years of the change in circumstance.

Sometimes which property should be chosen as the PPR is an obvious choice, for example a home which will not be sold during lifetime will not benefit from CGT relief whereas a property such as a London bolt hole which will cease to be used when an individual retires will. Otherwise, advice has been that the property which was expected to rise in value most should be elected to be the PPR. With the property market fluctuations we have seen in recent years, many individuals are reconsidering the elections made previously and opting now to make no such election and simply keep their options open until the time of sale.

If no elections have been made then which property is an individual’s PPR will be determined on the facts of each case. In some cases which property has been occupied as the main home will be obvious, but if the position is fluid this can help with keeping options for relief open.

The onus is on the taxpayer to provide the evidence of occupation, but with HMRC’s ever increasing ability to access information through their powerful Connect database we are seeing the number of HMRC enquiries rising where contradictory information is provided.

HMRC have been known to compare the utility bills of each property and request details of an owner’s diary to enable them to determine the ‘real’ PPR. It is therefore important that taxpayers who may wish to claim PPR relief are able to prove their occupation such as by diarising time spent at each property, ensuring utilities and other household bills are registered in their name and generally evidencing their occupation.

These changes will no doubt trigger individuals to review the benefits of selling property before the reliefs are withdrawn, especially given the large gains which usually accompany residential property sales. Consideration should also be given as to how any sale proceeds will be reinvested, especially if the desire is to remain in the UK property market in which case the SDLT cost will need to be taken into account.

If you are considering selling a UK property which you have not occupied throughout ownership it is worth seeking professional help to make sure you are utilising all available reliefs and are aware of the tax bill you are facing.

If you would like to discuss any of the above please contact me or your usual contact at Mercer & Hole.

7 mins

7 mins