From 6 April 2017, tax relief for finance costs (including mortgage interest) relating to residential property businesses was restricted with the changes phased in as follows:

As a result, by 2020/21, these costs will no longer be an allowable deduction against rental income but instead a 20% income tax reduction will be given.

These rules only apply to individual landlords owning residential property and not to companies, commercial properties and furnished holiday lets.

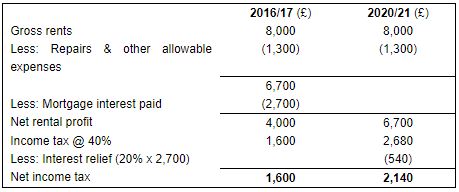

Example: Philip (a 40% taxpayer) owns a buy-to-let property purchased with a mortgage. We can see the effect of this change by comparing Philip’s tax position in 2016/17 with 2020/21:

As you will see, Phillip’s tax liability has increased by £540 and the effective tax rate on the net rental profit has increased from 40% to 53.5%. Phillip only has relatively modest interest outgoings however and these changes are likely to significantly impact larger property businesses funded with debt.

Who is affected?

This restriction impacts all taxpayers who incur finance costs in relation to their rental business and not just higher rate taxpayers. This is because basic rate taxpayers may find that, once the finance costs are disallowed, they are higher rate taxpayers. These changes can also increase the overall tax payable where the rental business is loss making. These complications are best illustrated in the next example.

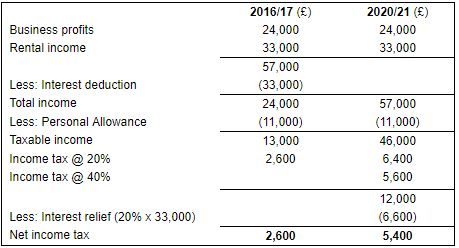

Example: Theresa (normally a 20% taxpayer) receives business profits of £24,000 and annual rental income of £33,000. As the property has a large mortgage with annual interest of £35,000, the rental business is loss making. Her tax position for 2016/17 and 2020/21 will differ as follows:

(*It is assumed that the 2016/17 tax bands and allowances will apply for 2020/21)

As a result of the restriction, Theresa is now a higher rate taxpayer. Theresa’s property letting business has made a loss of £2,000 but in 2020/21 she pays income tax of £2,800 in relation to this loss-making business! She will also lose most of her child benefit because her total income is over £50,000.

However, as her interest costs are greater than the letting income by £2,000, she will be able to carry forward a tax reduction of £400 (20% x £2,000) to set against a future income tax liability.

Knock-on effects

As interest is disallowed in the rental accounts, this increases overall taxable income. This could have a number of effects, such as pushing an individual into a higher rate of income tax and/or capital gains tax, reducing their personal allowance (if their income now exceeds £100,000), affecting their entitlement to child benefit (as illustrated above) and restricting the amount on which they can claim tax relief for pensions.

Incorporation of rental business

Highly leveraged landlords of residential properties are likely to be the worst affected by these changes. As this restriction only applies to individual landlords, some taxpayers are considering incorporating their property letting businesses, which is further driven by the fall in corporation tax to 17% by 2020.

However, there is scope for significant capital gains tax and SDLT charges to be triggered on incorporation, if relief is not available. There are also other considerations, such as the added administration and possibly higher rates of interest on company borrowings. Please refer to ‘Residential properties – time to incorporate?’ written by my colleague David Hadley,

New acquisitions

For new acquisitions, an appropriate ownership structure should be considered beforehand. Although there may be tax savings by holding property via a company where there is debt funding, the bigger picture needs to be considered, including profit extraction and long term exit planning. There is no ‘one size fits all’ solution and we therefore recommend you seek our advice prior to the acquisition.

If you would like to discuss any of the issues raised here, please get in touch with Alice Pearson or your usual contact at Mercer & Hole.

7 mins

7 mins