Non UK domiciliaries are only subject to UK Inheritance Tax (IHT) on their UK assets. Foreign assets are treated as excluded property, which are outside the scope of UK IHT while they are neither domiciled nor deemed domiciled in the UK (broadly once they have been resident in the UK for more than 15 out of the previous 20 tax years, under the proposed new rules).

It has been common practice for non UK domiciliaries to acquire UK residential property via a non UK company of which they are the ultimate beneficial owners. In doing so the owner was viewed as holding a foreign asset (the shares), which represented excluded property. Furthermore, the shares may have been settled on to a trust prior to the settlor becoming deemed domiciled in the UK and thereby preserving excluded property status for the future.

The government announced that with effect from 6 April 2017 an IHT charge would be imposed on UK residential property no matter how it is held. However, as a result of the June 2017 general election, the new rules have been placed on hold. We expect these provisions will be reintroduced in due course but it is not yet clear whether they will apply from 6 April 2017 or 6 April 2018.

We will outline the new rules using scenarios on the basis that these will be introduced from 6 April 2017 in accordance with draft legislation.

Common scenarios

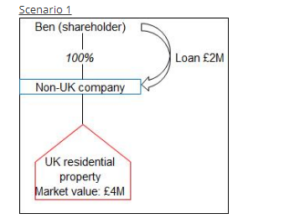

The value of the shares in Non UK company as attributable to the UK residential property falls within Ben’s personal estate for IHT purposes. If Ben makes a transfer of the shares during his lifetime or upon his death this will be an IHT event.

Debts: When determining the chargeable value of the shares, the company’s debts can be offset, which includes the loan from Ben of £2M (£4M-£2M=£2M). Debts are deducted proportionately from each of the company’s assets based on market value.

Although Ben’s loan is deductible when determining the chargeable value of the shares, he is also liable to IHT on the loan itself of £2M. Effectively, the full value of the property is exposed to IHT (£2M+£2M=£4M).

Two year rule: Following the sale of shares in Non UK company or the repayment of Ben’s loan, the proceeds of sale/loan repayment will continue to be subject to IHT for a two year period. However, if the company sells the property, IHT exposure ceases immediately.

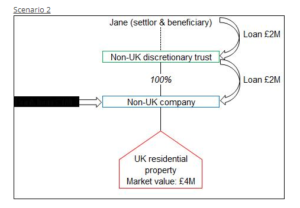

Both Jane (as settlor) and the trustees are exposed to IHT:

Settlor: As Jane is the settlor and also a beneficiary she has made a gift with reservation of benefit. As long as the reservation continues, the value of the shares in Non UK company as attributable to the UK residential property is within her estate and will be subject to IHT upon her death at 40%. Again, the company’s debts are deducted when determining the chargeable value of the shares (£4M-£2M-£1M=£1M)

Relevant loan: Where a loan is made to enable an individual, trustees or a partnership to acquire, maintain or improve UK residential property or to invest in a close company which uses the money to acquire, maintain or improve UK residential property the loan is a UK asset in the lender’s estate (along with the collateral for such loans). Therefore, the loan from Jane to the trustees of £2M also falls within her personal IHT estate (total exposure: £1M+£2M=£3M).

Trustees: The value of the shares in Non UK company as attributable to the UK residential property (£1M) is regarded as relevant property, which is subject to 10-year anniversary and exit charges (explained below). In addition, the loan from the trustees of £2M is also treated as relevant property (total relevant property: £1M+£2M=£3M).

10-year anniversary charge: IHT will be charged on every tenth anniversary of the trust at a maximum rate of 6% based on the value of relevant property on that occasion. It is reduced proportionately where the first charge takes place less than 10 years after 6 April 2017.

Exit charge: There will be an exit charge if and when relevant property leaves the trust. For example, if the trustees distribute the company shares or the UK property to a beneficiary.

As you will see, there is an element of double taxation as both the trustees and Jane have IHT exposure on the same property. This is a consequence of the gift with reservation of benefit provisions.

Options to reduce IHT exposure

There are a number of options and there is no single solution. It is important to consider all of the UK tax consequences of any restructuring, together with the long term objective:

- ‘De-envelope’ the property into personal ownership: Once removed from the trust, the trustees will no longer be subject to IHT in connection with the property. In addition, once removed from the company, the Annual Tax on Enveloped Dwellings (ATED) will no longer be in point (if applicable).

- Re-invest in non UK residential property: If the property is sold and replaced with assets which are not UK residential property (e.g. commercial property or shares),

- the shares in the company would fall outside the scope of IHT. The trust assets would also be treated as excluded property with no 10-year anniversary or exit charges.

- Exclude the settlor from benefitting: The settlor (and their spouse) could be irrevocably excluded from benefitting from the trust, which would limit the IHT exposure on the shares in the non UK company to the trustees only.

- Transfer the company shares from the trust into personal ownership: This would remove the trustees’ exposure to IHT and the shareholder/s can then gift shares to the next generation to spread the personal IHT exposure. However, ATED will still apply (if in point).

- Do nothing and accept the IHT exposure: There may be other non UK tax related reasons why the IHT exposure is a price worth paying. In which case, life insurance could be used to cover the IHT risk.

Our private client tax specialists can guide you through the complex layers to find the most appropriate solution for your circumstances.

If you wish to discuss this further, please contact Alice Pearson or a member of the Private Client Tax Services team for more advice.

7 mins

7 mins