With the advent of virtual content, logistics firms associated with the storage and delivery of physical entertainment media can find themselves left behind. The problems facing certain parts of the market were laid bare during a recent assignment conducted by our Corporate Advisory team.

The company’s circumstances included break up of the associated European group (insolvency proceedings were opened for group companies in Germany and France), loss of a major contract (65% of UK turnover), accumulating historical losses, and reliance on a contracting market sector (the distribution of physical entertainment media).

On losing the contract, the directors recognised the risk of insolvency and the need for specialist advice on how to act in the circumstances. We were retained as the company’s restructuring advisers with, amongst other instructions, a brief to consider the implications of commencing administration and the impact on the creditors of such a decision.

Crisis management and accelerate business review

The initial task was one of crisis management, to stabilise operations while sufficient information was gathered to allow for rational decisions to be made in respect of the directors’ continuing to trade in the short term.

The threat of insolvency, creditor enforcement, and cashflow constraints (not least as a result of the European group companies freezing intragroup payments) all added to the pressure the directors were facing in the immediate aftermath of the announcement that the contract would not be renewed at the end of its term.

As is almost invariably the case with financial crisis management assignments, cash is king. The immediate concern was whether there was sufficient cashflow to continue to trade on a day-to-day basis. If cash could be managed to allow for continued trading, the directors needed to demonstrate that continuing to trade would generate an enhanced realisation for creditors.

If the immediate threats were manageable, an accelerated business review would be able to identify business strengths and opportunities which, although requiring further exploration, could provide benefit to the creditors.

The opportunities included lucrative transition rates for the managed transfer of stock to a new provider; the possibility of protection of employment and the transfer of associated employee liabilities; and the potential to extract value from the group’s reliance on an IT department necessary for the trade (albeit within insolvency proceedings) of its larger European counterparts.

Contractual insolvency breach clauses threatened the company’s ability to benefit from the transition of stock, as well as weakening the protection of employment rights. The potential impact on the estate was material, and it was imperative to ensure the actions taken by the directors were in the interests of creditors.

Our review identified business strengths, including, cheap warehouse premises; accessible location; local and industry brand strength; and a dedicated, skilled, and loyal workforce; all of which could provide value to the business and improve the position of creditors.

The decline in the distribution of physical media, thanks to improved broadband and on-demand in-home streaming services, has been evident for a while (as Blockbuster found out to its cost). But disruption in associated industries, including retail and public services, provides prospective growth areas for a flexible, adaptable logistics business.

The exponential growth of the huge online retailers means that demand for storage and supply of millions of products, requiring delivery from a central warehouses to end users, continues to grow. The contraction of the public sector also sees a requirement for external storage and delivery of product to substantial public sector organisations such as the NHS, local authorities and the Ministry of Defence; all of which provide further opportunities for a progressive logistics business.

Crisis stabilisation

Stabilising the cash crisis through immediate negotiations with the exiting client to secure premium rates (and a short term payment horizon) during the termination period, was therefore of paramount importance.

It was evident that a managed process, spanning a period of trading prior to opening formal insolvency proceedings, with continuity through to a sale of the business, provided the directors with comfort that they were acting in the interests of the creditors.

The crisis focused on cashflow but the outcome was reliant on adding value for the creditors by harnessing the business’ strengths, maximising the immediate opportunities, and highlighting the market potential to interested parties.

No one wanted to be associated with a business continuing to trade post insolvency, without a documented plan to improve the return to creditors.

Managing cash, maximising realisations, and minimising liabilities

The threats to the business and legacy issues arising from the break-up of the European group meant that it was unlikely the company could be saved as a going concern.

However, after stabilising the business through management of the immediate cashflow issues, a five pronged business improvement plan was initiated:

- Achieve the benefits of transition through the continuation of trade during the termination period.

- Organise the employees to deliver the contractual wind-down services, and maximise Transfer of Undertakings (TUPE) protection.

- Compartmentalise and sell the IT division to the larger German counterpart.

- Approach market specific competitors to test the industry’s appetite for a pre-administration sale.

- Undertake an Accelerated M&A (AMA) assignment, in conjunction with appropriate agents, to identify potential business acquirers.

Negotiations on transition rates and payment terms were successful, not only delivering timely ongoing cashflow but also generating a profit, reducing the deficit to creditors.

Ongoing provision of service to the major client ensured that the employees working specifically on its contract at the transfer date benefitted from employee protection and transfer rights. The transfer of several employees was accepted by the new provider, while a considerable number accepted a Union-approved compensation payment.

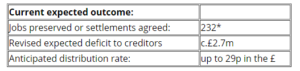

The expected return to the creditors as a result of continuing to service the contract until the transfer date increased dramatically.

The sale of the IT business unit prior to formal insolvency proceedings also generated cash and transferred employee liabilities to the acquiring party. The receipt of a lump sum of cash improved the position of creditors, while the transfer of employees to the new business reduced claims in the overall estate.

The initial aspects of the value enhancement plan proved successful and improved the expected return to the creditors. During the transition period, approaches were made to industry competitors, the only parties who may have been interested in a share acquisition. As was anticipated, none of those approached were interested in progressing a pre-insolvency transaction because of the historic liabilities to which they might become exposed.

The solution

The direct approach to competitors and the wider AMA assignment had confirmed that the problems facing the company prevented a non-insolvency transaction being completed.

However, the exercise highlighted a number of interested parties and once the benefits of the transition and disposal of the IT unit had been realised, a post administration sale could be pursued.

Trading continued for some 16 weeks in administration in order to achieve the best available sale of the business and assets. The creditors approved the strategy set out in the administrators’ proposals, following which a sale of the business was concluded.

The sale continued the theme of minimising liabilities and maximising realisations, seeing the novation of client contracts (avoiding non-performance claims against the estate), protection of employment (removing employee claims from the estate), maximising the realisation of book debts, and generating consideration for the business, both immediately on completion and through a deferred payment schedule.

*a total of 15 redundancies followed appointment. Several employees resigned or otherwise left the business during the intervening period from initial instruction.

Don’t panic!

Changing industries need adaptable businesses. It can be difficult to keep up with the pace of change while facing financial stress but not adapting can prove fatal.

Providing a business with the breathing space to assess threats and identify opportunities, as well as to build on strengths and react to weaknesses, will allow the directors to navigate their business during difficult periods.

Financially and operationally stressed businesses, trading in sectors facing disruption, need to seek advice focused on a rigorous and disciplined proposal to protect the interests of the creditors.

In this instance the directors were focused on the protection of creditors through the commencement of an administration process, but administration at the outset would have been hugely value destructive. By managing the immediate cashflow threat, undertaking a business review, and setting out a value enhancement programme, the deficit to creditors fell dramatically, culminating in the approval of the administrators’ proposals and conclusion of the sale of the business.

If you would like to discuss any of the aspects raised in this article, please get in touch.

7 mins

7 mins