The Corporation Tax rate stays at 19% until 1 April 2023 for all companies. However, from 1 April 2023, the Corporation Tax main rate is increasing to 25% for companies with profits over £250,000.

Though the increase is delayed, this is quite substantial compared to the current level of 19%. To soften the impact, companies with taxable profits of £50,000 or less will continue to pay Corporation Tax at 19%. Companies with profits between £50,000 and £250,000 will pay tax at the new main rate of 25% reduced by a marginal relief providing a gradual increase in the effective Corporation Tax rate.

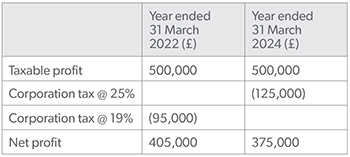

So, if a company makes taxable profits of say £500,000, the difference will be as follows:

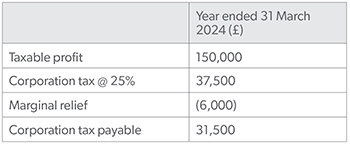

Precise details as to how marginal relief is to operate have not yet been published. However, this is not a new concept and based on how it has previously operated, we have a good idea. Let us say, therefore, that a company instead makes £150,000 – the position will likely be:

This produces an ‘effective rate’ of 21%.

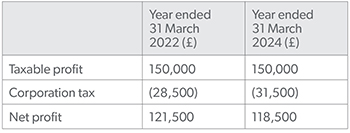

So, the comparatives will be:

The increased tax cost here is £3,000.

Further complications

The lower and upper limits will be proportionately reduced for short accounting periods and also reduced where there are associated companies.

Broadly, a company is associated with another company at a particular time if, at that time or at any other time within the preceding 12 months:

- one company has control of the other; or

- both companies are under the control of the same person or group of persons

If, therefore, there are two associated companies, the new limits become £25,000 and £125,000; if three companies then £16,667 and £83,333, and so on. As can be seen with just a few associates, many companies will easily fall into the main rate or marginal rate position and so care must be taken.

Finally, it should be noted that some investment businesses that are broadly controlled by five or fewer shareholders will be excluded from benefiting from the lower rate.

Super deduction for companies investing in capital equipment

Companies who incur qualifying capital expenditure between 1 April 2021 and 31 March 2023 will be eligible to claim a new super-deduction against their corporation tax profits by way of an enhanced capital allowance of 130%. This enhanced allowance will apply to most new items of plant and machinery and is designed to encourage new investment although has been limited to corporate entities even though businesses can generally also claim allowances for capital expenditure.

For investments into other plant and machinery assets that ordinarily would only be eligible for the 6% special rate writing down allowances, a new temporary first year allowance of 50% will be introduced covering the same 2-year period. Whilst this measure is aimed at stimulating business investment, the benefit of the enhanced deduction will only be available at the current 19% rate of corporation tax and will cease the day before the rate (and therefore the higher tax benefit) increases to 25%.

The tax incentive, and therefore cash flow benefit, for the year of investment for expenditure of, say, £500,000 will be £106,400; being the difference between 130% and the current rate of writing down allowance of 18% multiplied by the current rate of corporation tax.

Complex rules accompany this change in respect of the amount of tax payable when such assets are disposed of, as well as dealing with the calculation for apportioning relief for companies whose accounting period straddles 1 April 2023.

Companies with a 31 March 2021 year end may need to make some quick decisions in relation to proposed investment in the next few weeks as to whether to stick with the cash flow benefit resulting in pre year end investment vs. a higher deduction 12 months later.

If you think you may be affected and would like further advice or support from us regarding the Corporate Tax rate increase, please don’t hesitate to speak to Martin Coulson or another member of our team.

7 mins

7 mins