From 6 April 2019 the personal allowance is set to increase from £11,850 to £12,500 and with this comes an increase in the threshold at which an individuals’ income and capital gains are subject to higher rate tax too. Currently the threshold for higher rate tax is £34,500 and this will be increased to £37,500 from 6 April 2019, meaning that an individual can earn up to £50,000 per annum and not suffer higher rate tax. For some, this is a total annual saving of £730 but that is not the case for everyone as I will examine in more detail below.

Implications for those with income in excess of £100,000

For individuals with income in excess of £100,000, the personal allowance is reduced by £1 for every £2 of income in excess of £100,000. Currently, those with income of more than £123,700 are not entitled to any personal allowance and that threshold will increase to £125,000 from next April.

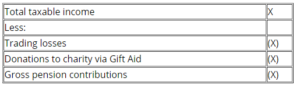

It is helpful to explain what “income” means for these purposes and in technical speak we refer to this as “adjusted net income’. This is calculated as follows:

Thus it is possible to reduce the level of ‘adjusted net income’ to below £100,000 by virtue of gifts to charity and by making pension contributions.

Planning with pension contributions

For those with ‘adjusted net income’ between £100,000 and £125,000, pension contributions are an efficient way of preserving your personal allowance. Tax relief at the basic rate of tax is given by way of a 20% top up to the contribution by the Government. The net contribution made plus the tax relief received will go to reduce the ‘adjusted net income’ as outlined above. Higher rate and additional rate taxpayers will also receive additional tax relief by way of an extension to their 40% and 45% tax bands. This relief can either be claimed via a tax return or an adjustment to the individual’s tax code.

Pension contributions can therefore be made annually to reduce ‘adjusted net income’ to such a level whereby the individual is entitled to part or all of the personal allowance. Combined with the tax relief on the pension contribution this type of planning can actually save up to 60% in income tax simply by securing the personal allowance.

An illustration of the potential saving

Take an individual with earned income of £125,000 per annum, they would not be entitled to the personal allowance for the 2019/20 tax year and they would suffer tax at the following rates:

£37,500 at the basic rate of 20%: £7,500

£87,500 at the higher rate of 40%: £35,000

Total income tax: £42,500

A pension contribution of £20,000 (£25,000 including the government top up) would reduce the ‘adjusted net income’ to £100,000, ensuring entitlement to the full personal allowance. The following tax rates would apply thereafter:

£12,500 personal allowance at 0%: NIL

£62,500 (£37,500 + £25,000) at the basic rate of 20%: £12,500

£50,000 at the basic rate of 40%: £20,000

Total income tax payable: £32,500

This results in a decrease in income tax of £10,000, and has resulted in £5,000 in additional tax relief in the form of the government top up to the personal pension (provided they are within the Annual Allowance for pension contributions as outlined in further detail below).

In summary, for those suffering a 60% tax rate – being the loss of the personal allowance and the higher rate of tax at 40% – an individual can receive £25,000 into their pension at a net cost of £10,000.

Too good to be true?!

When adding to a pension consideration should be given to the Annual Allowance and Lifetime Allowance and where either of these are exceeded additional tax liabilities can be triggered. Although there were no changes announced in the Budget, a reminder of what they are follows below:

The Annual Allowance (AA)

Gross pension contributions plus any employer pension contributions are limited to the AA of £40,000 per annum. This figure is reduced if the individual has ‘adjusted income’ of over £110,000 and ‘threshold income’ of over £150,000.

‘Adjusted income’ is net income (after occupational pension contributions paid under a net pay scheme) less gross pension contributions.

‘Threshold income’ is net income plus pension contributions on which tax relief is receive and plus pension contributions paid by the employer.

These tests can reduce the AA down to £10,000 per annum. It should be noted however that unused AA from the previous three tax years can be carried forward and used. Contributions in excess of the AA will be subject to a tax charge at the individuals’ marginal rate of tax.

Lifetime Allowance (LTA)

The LTA is a limit on the value of pension benefit that can be drawn without attracting an additional tax charge. The LTA is assessed at various points in time:

- Whenever there is a Benefit Crystallisation

- At death if before age 75

- At age 75.

The LTA is currently £1.03m and will increase to £1.055m from 6 April 2019, where the value of the pension exceeds this amount, on drawing the excess the LTA charge applies at either:

- 25% if excess is taken as income, or

- 55% if excess is taken as a lump sum.

Whilst the income tax opportunity here is attractive, the LTA needs to be considered as part of the puzzle too and the contribution should not be made in isolation without sense checking other factors.

How can we help?

We can proactively review your entitlement to the personal allowance with a view to ensuring the maximum allowance is achieved annually. This should reviewed annually as there is no ability to carry back or offset the contribution to an earlier tax year. We can also consider the wider implications concerning your pension and ensure mitigation of any potential pitfalls. Please contact me or your Mercer & Hole contact for our help.

7 mins

7 mins