The annual Tax on Enveloped Dwellings charge (ATED) is a tax charge on companies and certain other corporate entities that own a UK residential dwelling where the value is over £500,000. Although certain exemptions are available (e.g. where the property is let to a 3rd party on commercial terms) these need to be claimed and where a relevant property is held an ATED return needs to be submitted each year whether or not an exemption is claimed. The deadline to make the return and pay the charge for the 1 April 2018 to 31 March 2019 year is 30 April 2018. This is also the deadline to submit ATED relief declaration forms.

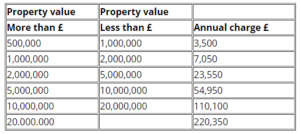

The amount of tax payable depends on the charge band the property value falls into and for 2017/18 is as follows:

The charge band is currently based on the value of the property at 1 April 2012, or the cost if bought subsequently. However, under the ATED rules the properties need to be revalued every five years. Therefore a new valuation is required as at 1 April 2017, to be used from 1 April 2018 and for the subsequent five years. This new valuation applies to all relevant properties held at 1 April 2017 even if purchased in the last 5 years.

Where properties were held at 1 April 2017 and it is believed that a valuation at that date may bring a property into ATED for the first time or put it into a different band-width I would recommend a formal property valuation is obtained.

7 mins

7 mins