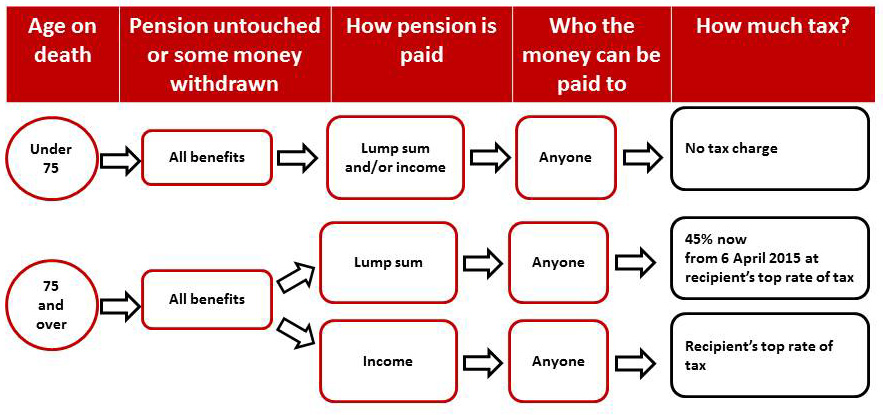

From April 2015, if an individual dies before they reach the age of 75, they will be able to leave the balance of their pension fund to anyone as a lump sum completely tax free. This applies to a ‘defined contribution’ pension fund and is regardless of whether any previous withdrawals have been made. For the beneficiary, they will pay no tax on the money they withdraw whether it is taken as a single lump sum or accessed as an income stream.

Anyone who dies over the age of 75 will also be able to nominate any beneficiary to receive their pension. The nominee has the flexibility of being able to access the pension fund and draw an income at any age and will pay tax at their marginal rate of income tax. There are no restrictions on how much of the pension fund the beneficiary can withdraw at any one time. However, if the beneficiary elects to receive the pension as a lump sum payment, this will be subject to a flat tax charge of 45% if taken before 5 April 2016 and thereafter will be taxable at the recipient’s marginal rate of tax.

Similar changes have been made to the death benefits under annuity contracts. From April 2015, when an individual dies before age 75 with a joint life annuity or an annuity providing a guaranteed payment period, their surviving spouse will receive all future annuity payments free of tax; these payments would have previously been taxed at their marginal rates. If the original policyholder dies after the age of 75, income paid to the surviving spouse will continue to be taxable at their own rate.

The term beneficiary (for all benefits) is now extended to include anybody that the individual chooses to nominate.

Under the new rules, pension funds will be able to be passed through multiple generations. The first beneficiary to take over the fund will be known as a ‘nominee’, upon the nominee’s death the fund will be passed onto their nominated beneficiary, known as the ‘successor’. This now means that pension funds can play a key role in succession and inheritance tax planning. It allows an individual to view it effectively as a family trust fund for future generations.

8 mins

8 mins