1. CGT for non UK residents

Non UK residents have, in general, been outside the scope of UK CGT. With effect from 6 April 2015, non UK residents will be subject to CGT on the disposal of UK residential property. Non UK residents include individuals, trustees and non resident companies and funds unless these are already caught by the ATED related gains discussed below.

The property within the new scope will be ‘property used or suitable for use as a dwelling’ and therefore includes residential let property too. Some property will be excluded such as boarding schools and nursing homes, to name just a few examples. All relevant properties are included, irrespective of their value.

The gain chargeable will only be the gain relating to the period after 5 April 2015. Therefore, a non resident individual who has held a property since January 2005 and sells it in December 2015 will be taxable on the gain accruing in the period 6 April 2015 to date of disposal in December 2015. To calculate this will require knowledge of the market value of the property as at 5 April 2015 although this does not need to be obtained until the property is actually sold.

There is an alternative method of computation available if it produces a more advantageous result. That is to pro rate the whole gain across the relevant periods. In the above example, the gain arising between date of acquisition in January 2005 and disposal in December 2015 would be calculated and apportioned on a time basis between the period pre 6 April 2015 and the period thereafter. The non resident can choose whichever method is beneficial to him.

Obviously, a non resident coming to the UK will need to ensure that he or she does not accidentally become UK resident under the Statutory Residence Rules. If so, then the CGT charged will be by reference to the original cost and not just the gain accruing after 5 April 2015.

Principal Private Residence Relief (PPR)

PPR exempts gains relating to qualifying periods from CGT. The last 18 months of ownership should always qualify for PPR if a property has been used at some stage as the main residence of the person. However, in practice, the wider availability of PPR to a non UK resident will be much more limited. By definition, if an individual is not UK resident, then it is unlikely that his main residence is in the UK. However, there will be circumstances where it is possible to be non UK resident and be entitled to claim main residence relief. The key test is whether the individual or spouse have been resident in the UK for 90 days or more in each relevant tax year.

Obviously, for many individuals, if this test is met, there will be risk of actually becoming UK resident again under the Statutory Residence Test and detailed advice will be necessary.

Rate of Capital Gains Tax

The rate of CGT will be 18% for a basic rate taxpayer and 28% for a higher rate taxpayer. Trustees will pay CGT at the rate of 28%. A non resident company will pay 20% tax on gains arising (except ATED related gains below) which brings non resident companies in line with UK companies.

Payment of the tax

The disposal needs to be reported on a non resident CGT return within 30 days with payment being made as part of the usual end of year payment although there is also the option to pay the tax at the same time as reporting it on the CGT return.

2. Annual Tax on Enveloped Dwellings (ATED) – related Gains

The ATED regime applies to a UK residential property owned by non natural persons. These are defined as a company, UK or non UK, a collective investment vehicle, or a partnership of which one or more members is a company.

The ATED regime was first introduced in April 2013 by reference to enveloped property with a value of £2m or more at 1 April 2012. If the property, otherwise caught by ATED, would have had a value of £1m or more at 1 April 2012 or later, if acquired later, then it will come into the ATED regime from April 2015. The threshold reduces again to just £500,000 from April 2016.

Annual Charge

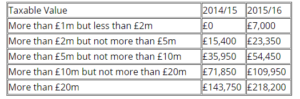

The ATED charge which is paid annually. The ATED charge is being increased again and the charges and the value thresholds to which they will be applied are set out below:

Reliefs and filing obligations

Reliefs are available where the property is being used for commercial letting.

Even if a relief is claimed, a return must still be completed and filed. The usual filing deadline is 30 April after the tax year end. However, for properties coming into the charge due to the decrease in the threshold to £1m there is a concession in the first year and the return must be filed by 31 October 2015.

ATED related Capital Gains

An ATED related gain will arise when a UK residential property is disposed of that is within the ATED regime and where an ATED charge is payable. Where an exemption from the charge is claimed (because a relief applies), the gain arising on disposal will not be an ATED related gain. However, it will still be a gain of the company and subject to a review of other possible UK tax charges.

The rate of CGT for an ATED gain is 28%.

8 mins

8 mins