It is unlikely to have escaped your attention that the Government announced its plans for Health and Social Care reform in the UK on 7 September 2021.

As widely anticipated in the press, this is partly being funded by an increase in National Insurance contributions from April 2022. However, the surprise announcement was that this will coincide with a 1.25% increase in the income tax rates on dividend income.

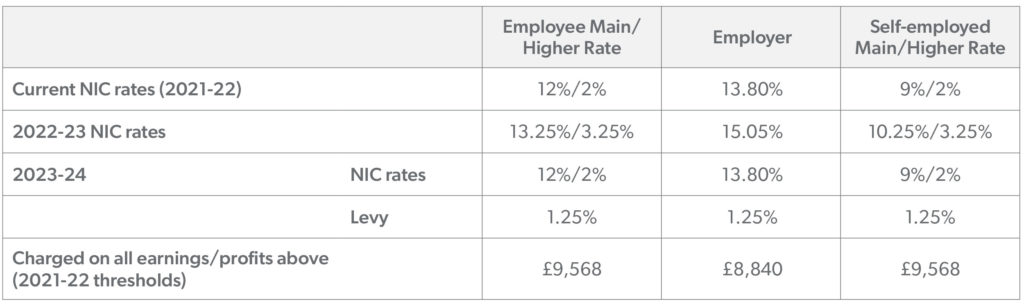

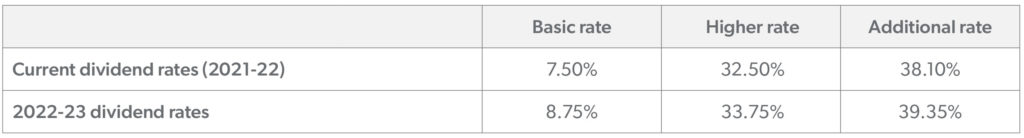

The increased rates can be summarised as follows:

National Insurance

Dividends

Key points

- The additional rate is being introduced from April 2022 – initially being an increase in National Insurance contributions, but from April 2023 it will be a separate identifiable levy.

- Applies to working age employees, employers and the self-employed. From April 2023 it will also apply to those who work above state pension age.

- It does not impact on Class 2 contributions (flat rate for the self-employed) or Class 3 (voluntary contributions)

- Taking in to account the employees and employers additional 1.25% this is a total of 2.5% increase in contribution

- Existing National Insurance contribution reliefs to support employers will apply to the levy e.g. companies employing apprentices under 25, all people under 21, veterans and employers in Freeports will not pay the levy for these employees in certain circumstances.

- Employment allowance, designed to discount the National Insurance bills of the smallest businesses, will apply to the levy.

- Dividend income tax rates in all income tax bands will increase by 1.25% from the 2022/23 tax year.

- It is not clear from the guidance at present as to whether this will also create an increase in s455 tax for companies (a tax on loans and payments to certain director/shareholders) and the trust tax rate on dividends but the current wording does not appear to rule this out.

These changes, along with the upcoming increase to corporation tax rates from 1 April 2023, mean that owner-managers will need to consider the financial impact on their business.

However, help is at hand to talk through the changes. If you would like further guidance or advice, contact Jacqui Gudgion.

8 mins

8 mins