Historically, non UK residents have generally been outside the scope of CGT in the UK unless caught by anti avoidance rules. That is about to change. With effect from 6 April 2015, CGT will extend to disposals of residential property by non UK residents.

Some of the detail of the new CGT regime was announced this week. Essentially, it will apply to disposals by non UK resident individuals, trusts and companies. We examine some of the detail below.

Non UK resident individuals and trustees

Non UK resident individuals and trustees will be subject to CGT at 28% on gains realised on the disposal of UK residential properties, whether these are let or owner occupied. The gain charged will only be the gain accruing post 5 April 2015.

Trusts

Under current rules non resident trustees are not liable to UK CGT. Anti avoidance legislation then applies so that a UK resident beneficiary is charged to CGT on gains matched to a benefit they receive.

A disposal of UK residential property by the trustees after 5 April 2015 will immediately be taxable on the trustees in relation to the gain accruing from that date only. The pre 5 April accrued gain will still be attributed to benefits received by UK resident beneficiaries.

Where the trustees own a UK property that is occupied by a beneficiary, principal private residence relief (PPR) may be available to exempt the gain from CGT, if the relevant conditions are met. However, there are some restrictions coming into force for PPR relief for non residents.

Principal Private Residence (PPR)

PPR relief is available to exempt from CGT the gain arising on the disposal of a property that is a person’s main residence. PPR relief is not available for properties owned by companies and this includes non resident companies.

Some individuals have multiple homes across many jurisdictions. Until now, they could choose which one to elect to be their PPR and this enabled relief to be obtained by reference to that residence.

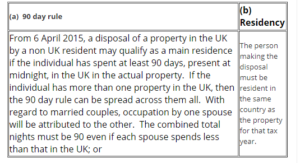

The government has announced that, with effect from 6 April 2015, the following factors must be present if a property is to be elected as a main residence:

What action may now be necessary?

Some non UK resident individuals may need to review whether they will be entitled to PPR relief in future by reference to a UK home and whether the 90 day rule, if observed, will disturb their residence position;

UK resident individuals electing that an overseas property is their main residence may need to reconsider this in light of this announcement.

Non UK resident companies

The position for companies is complicated further with the interaction of ATED (Annual Tax on Enveloped Dwellings). From 6 April 2015, a non resident company disposing of a UK residential property will now be subject to CGT on the gain accruing after 6 April 2015. The rate of tax payable will be the company tax rate which is currently 20%. The tax will bite whether the property is let or not, although ATED may also be in point if the property is not let. If so, we need to think about how the new charge works in conjunction with the ATED rules.

Interaction with ATED

By way of a reminder, ATED was introduced from 1 April 2013 and applies where a UK residential property is held by a non natural person which includes a corporate. Unless the property is let out on commercial terms to third parties, it is generally caught by the ATED regime (with some exceptions). The ATED capital gain is the gain accruing in the period 6 April 2013 to the date of disposal and will be charged to CGT at 28%.

As can be seen, a disposal could technically be both within ATED and in the new regime where the disposal takes place after 6 April 2015. If so, the ATED regime takes priority.

Extension of ATED

The ATED regime was first applicable where a relevant property had a value of £2m or more on 1 April 2012. This is about to be extended. With effect from 1 April 2015, properties with a value between £1m to £2m (as at 1 April 2012 or later, if acquired later) will also be caught if the relevant factors are present and this threshold extends again to properties with a value between £500,000 to £1m from 1 April 2016.

Disposals by these new ATED companies

For disposals made within the first year in which ATED applies, the company tax rate of 20% will apply to the gain accruing in that tax year. The gain accruing post 6 April 2015, will be liable at the CGT rate of 28%.

Gains accruing before 6 April 2015 may be taxed under anti avoidance provisions and careful planning and advice will be needed to ensure the correct position is identified.

Non ATED companies

Following on from the above, some non UK resident companies will not yet be caught by the ATED regime. Some may choose to dispose of the property or properties before such time. If a company, not caught by ATED, disposes of a property before 6 April 2015, then the gain arising will not be subject to UK CGT although it may ultimately flow through to a UK resident participator if the relevant conditions are present.

Future steps

Corporate ownership may still bring advantages in many circumstances, notwithstanding the complexities above. Understanding the implications is key and we can advise on these with regard to current structures and structuring for the future.

7 mins

7 mins